Weekly highlights

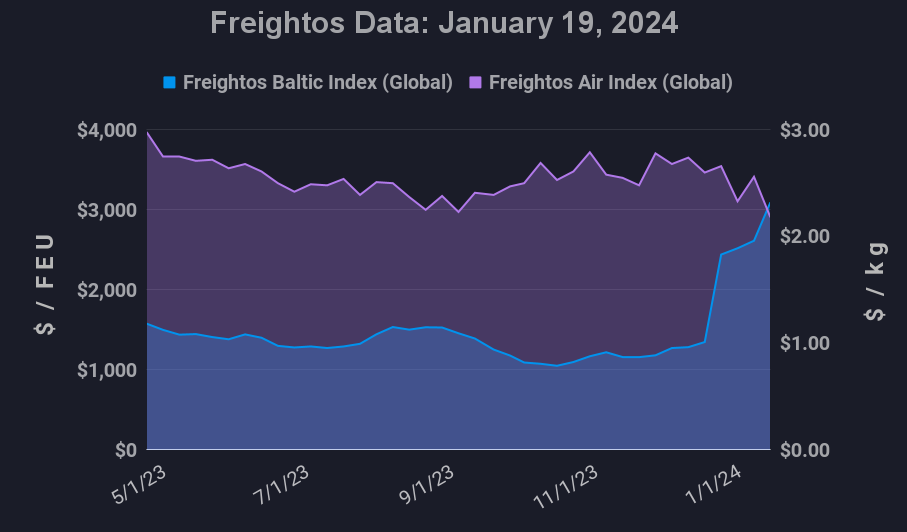

Ocean rates – Freightos Baltic Index

- Asia-US West Coast prices (FBX01 Weekly) increased 15% to $2,966/FEU.

- Asia-US East Coast prices (FBX03 Weekly) increased 19% to $5,094/FEU.

- Asia-N. Europe prices (FBX11 Weekly) increased 15% to $5,492/FEU.

- Asia-Mediterranean prices (FBX13 Weekly) increased 25% to $6,773/FEU.

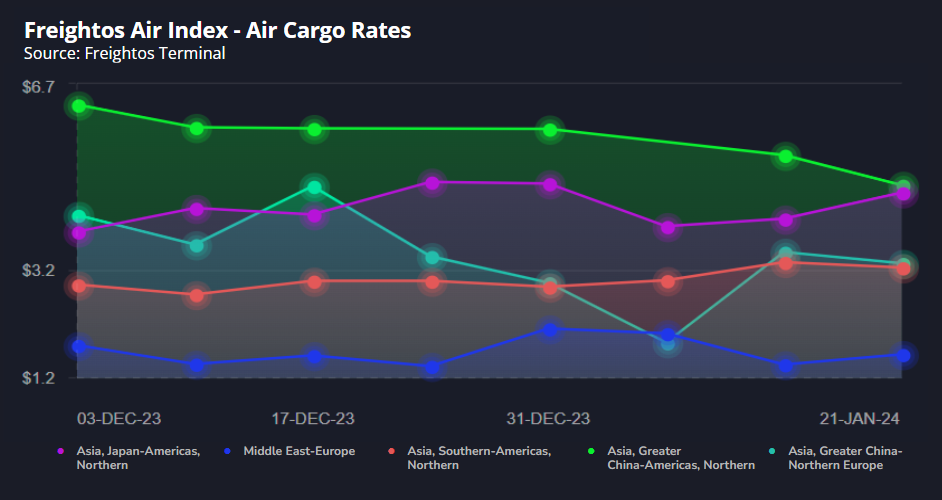

Air rates – Freightos Air Index

- China – N. America weekly prices decreased 10% to $4.8/kg.

- China – N. Europe weekly prices fell 6% to $3.34/kg.

- N. Europe – N. America weekly prices increased 5% to $1.94/kg.

Dive deeper into freight data that matters

Stay in the know in the now with instant freight data reporting

Analysis

Though US and UK strikes on Houthi positions continue this week, so do Houthi attacks on Red Sea vessels, with President Biden stating that the intensified efforts have not yet succeeded to provide deterrence.

As diversions away from the Red Sea continue just two and a half weeks before Lunar New Year, and carriers are still working to adjust their sailing speeds and add extra vessels to accommodate the longer routes, ocean freight disruptions and cost increases may be reaching their peak.

Empty container shortages in some Asian export hubs are posing a challenge to shippers eager to move goods before the holiday slowdown. Robert Katchatryan, CEO of freight forwarder FreightRight, reports that, last week, equipment shortages were already noticeable in Ningbo, where “alongside specialized equipment, even the regular 40’ and HC containers were becoming limited.”

Other shippers, hoping that rates and disruptions will ease after LNY, are canceling orders and causing problems for exporters. Despite reported disruptions to schedules and some vessel bunching at Asian hubs, congestion does not seem to be a serious problem yet, with most N. American ports already reporting that they’ve closed the gaps in arrivals due to diverted vessels or expect to do so soon.

Ocean rates increased 15-25% on the major ex-Asia tradelanes last week, with Asia – N. America West Coast prices nearing the $3k/FEU mark, rates to the East Coast and N. Europe surpassing $5k/FEU and prices to the Mediterranean climbing to almost $6,700/FEU. But as West Coast daily rates so far this week are approaching $4k/FEU and East Coast prices are up at the $6k/FEU mark, Asia to N. Europe and Mediterranean daily rates have mostly leveled off.

Congestion, shifts of capacity to Suez Canal lanes, and equipment shortages may not be impacting non-Red Sea lanes as much as carriers had anticipated, as transatlantic rates have yet to climb and some carriers are postponing planned GRIs and surcharges until February.

In another positive development for ocean freight, though total Panama Canal transits for all sectors hit a new low in December as many bulkers and tankers are taking alternate routes, container traffic – prioritized via advance bookings – has been impacted the least, with most services continuing to use the canal.

Ocean delays and shortages due to the Red Sea crisis are reportedly starting to shift some ex-Asia ocean volumes to rail and air cargo alternatives. And though Freightos Air Index data shows that air cargo rates from China to N. Europe and N. America have eased since the start of the year, prices from South Asia to N. America which have increased 12% since the start of the year and rates from the Middle East – important for sea-air options – to N. Europe climbed 13% last week, possibly reflecting some ocean to air shift.

Freight news travels faster than cargo

Get industry-leading insights in your inbox.