Weekly highlights

Ocean rates – Freightos Baltic Index

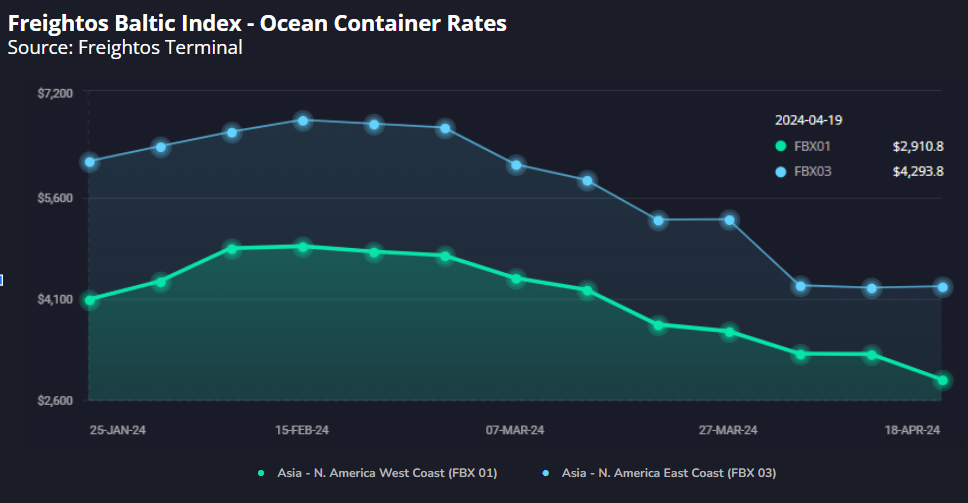

- Asia-US West Coast prices (FBX01 Weekly) fell 11% to $2,911/FEU.

- Asia-US East Coast prices (FBX03 Weekly) were level at $4,294/FEU.

- Asia-N. Europe prices (FBX11 Weekly) fell 7% to $3,304/FEU.

- Asia-Mediterranean prices (FBX13 Weekly) fell 2% to $4,364/FEU.

Air rates – Freightos Air Index

- China – N. America weekly prices decreased 16% to $5.18/kg.

- China – N. Europe weekly prices increased 8% to $3.55/kg.

- N. Europe – N. America weekly prices fell 4% to $1.80/kg.

Dive deeper into freight data that matters

Stay in the know in the now with instant freight data reporting

Analysis

Following Iran’s missile and drone attack on Israel, and Israel’s retaliatory strike last week, tension between the two may be easing, which may decrease the risk of additional Iranian vessel seizures in the Strait of Hormuz for now.

Iran continues to hold the MSC-operated Aries and its crew, meaning that several hundred India-bound loaded containers will not arrive any time soon, and several thousand export containers waiting to depart from India on the Aries may face delays as well.

India – Middle East shipments may face higher insurance costs as a result of this new threat, and though an escalation of actions by Iran in the strait would likely impact regional container trade operationally and in terms of higher freight rates – and if container flows to Dubai were affected, sea-air traffic through the key UAE hub would also be disrupted – so far there are no additional reports of disruptions and Freightos Terminal rate data ex-India shows no effect either.

Ocean rates beyond the Middle East and S. Asia were not impacted by this latest disruption either. Ex-Asia prices decreased somewhat or were level last week, and remain well below their early-year peaks. However, Asia – N. America rates remain 90% higher than in 2019 to the West Coast and 60% higher to the East Coast at about $3,000/FEU and $4,300/FEU respectively, as Red Sea diversions continue to absorb capacity and make blank sailings rare even during these slow-season months.

Likewise, Asia – N. Europe and Mediterranean prices are each more than double 2019 levels, and while rate announcements for May show some carriers aim to keep prices at about their current $3,300/FEU and $4,300/FEU levels respectively, others plan to introduce GRIs to try and push N. Europe rates up to $4,500/FEU and Mediterranean prices up to $5,600/FEU.

The Panama Canal Authority has announced that it will further ease low-water restrictions as rainfall increases. The PCA will increase daily transits to 31 by mid-May and to 32 starting in June – just below the pre-drought norm of 36 – and for the first time since restrictions were introduced almost a year ago, they will increase the maximum draft level from 13.41m to 13.71m in mid-June.

In air cargo, a severe storm caused flooding in Dubai that led to a 24-hour closure of the airport last week and 300 canceled flights, though operations were expected to recover quickly.

B2C e-commerce volumes continue to be the big driver of demand and worries about available capacity out of China, especially late in the year during air’s peak season. Freightos Air Index rates ex-China remained elevated at $5.18/kg to N. America and $3.55/kg to Europe last week. Some carriers are taking steps to add capacity in response, including CMA CGM’s newly-announced transpacific service which will launch in June, though capacity is still expected to get even tighter in Q4.

Freight news travels faster than cargo

Get industry-leading insights in your inbox.