A demand framework for Covid-19 from crisis response to the new normal

With the right data, consumer brands can determine whether their demand is rising, falling, or re-distributing due to COVID-19, without waiting for retailers

Keep readingRussia’s war in Ukraine has captured the attention of the entire world. The effects of this war are immediate on the Ukrainian people as well as have heavy implications for the rest of the world. The secondary impacts of the war are beginning to be felt more globally in supply chains, stock markets and other international operations.

These secondary impacts will continue to have tangible repercussions on international business for years to come. Even assuming the war ends before the summer, the world is facing ripple effects that will crash into every aspect of life.

Picture an earthquake hitting all of a country’s largest cities. Its people are displaced, many have perished and aftershocks are still being felt. Now, tsunamis are building out to sea. Their impact and timing is uncertain, but it can be safely assumed that they will make landfall in many areas throughout the world. While these far-flung countries may have felt distant or separate from the conflict when it began, they may now find themselves in the path of the ‘wave.’

No one can control mother nature, much like we cannot go back into the past and prevent the war from starting. Now, it’s up to the global community to offer aid to the people directly impacted, those in surrounding areas taking in refugees and to begin planning for the resulting “tsunamis.” Supply chain professionals have a unique opportunity to get ahead of these ripple effects and take action now to help the global community cope with the fallout from the invasion.

The devastation experienced by Ukraine and its people has prompted the western world to levy sanctions on Russia, the idea being to put so much pressure on Russia’s economy that they will pack up their military and go home. Perhaps France’s Foreign Minister, Jean-Yves Le Drian, said it best when he stated that the sanctions aim at “asphyxiating Russia’s economy.” Many businesses have also joined the fight to put economic pressure on Russia by pulling operations out of the country or ceasing sales to Russia entirely.

Reuters has been tracking all major sanctions since the crisis began. Some of the most notable actions take by government and individual companies include:

These actions, while necessary, are beginning to show early side effects. This is especially true in the energy sector, hard hit by sanctions that significantly limit the amount of energy that can be imported from Russia. Since Russia exports roughly 10% of the world’s natural gas and oil, these actions have had an immediate effect on prices for companies as well as individuals. Scarcity has driven up prices as well as inflation, fear of turmoil and opportunists looking to capitalize on the uncertainty.

So far, energy prices have gone up drastically, but there is still plenty of oil and gas to go around. Countries are diversifying where they source their supply from as well as investing in new production that will ease the burden. Long-term, it’s expected that gas prices will remain higher than before the invasion due to inflation, but won’t continue to experience the significant volatility of the last month.

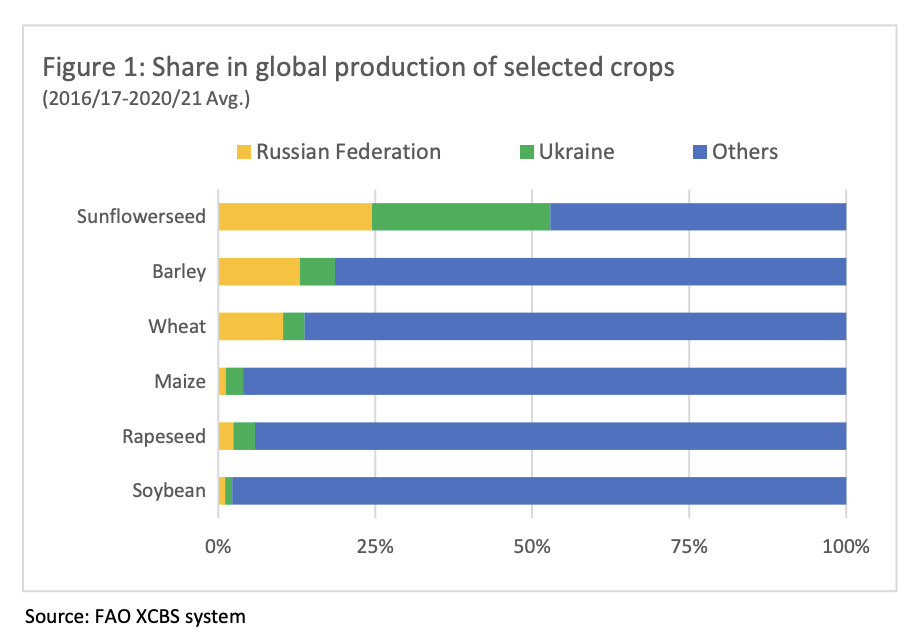

There is a silent tsunami building momentum, however, that will likely have far wider reaching and more dangerous repercussions for the world than the energy shortage. Ukraine and Russia are key producers of staple food products such as barley and wheat and are main suppliers for already food-insecure regions of the world. Both countries are net exporters of agricultural products, and they both play a crucial role in supplying global markets in food. Concerningly, a handful of countries rely predominantly on Ukraine and Russia for these staples, which could leave them especially vulnerable to food scarcity as the invasion cripples supply chains. Some notable countries include Egypt, Turkey, Bangladesh and Iran which buy 60% of their wheat from Russia and Ukraine.

The Rome-based Food & Agricultural Organization of the United Nations published a report discussing the importance of Ukraine and the Russian Federation for global agricultural markets and the risks associated with the current conflict. In it, they state:

“FAO’s simulations gauging the potential impacts of a sudden and steep reduction in grain and sunflower seed exports by the two countries indicate that these shortfalls could only be partially compensated by alternative origins during the 2022/23 marketing season. The capacity of many of these origins to boost output and shipments may be limited by high production input costs. Worryingly, the resulting global supply gap could push up international food and feed prices by 8 to 22 percent above their already elevated levels.”

Besides greatly reduced exports from Ukraine and Russia of staple food products, other countries that grow and export crops will also face additional hardships. In addition to high gas prices for powering farming equipment, the fertilizer supply chain is also taking a hit.

Russia is the world’s largest producer of fertilizer and is responsible for 22% of global ammonia exports, which is a key ingredient in nitrogen fertilizers. According to the American Farm Bureau Federation, “fertilizer costs account for approximately 15% of total cash costs in the U.S., fertilizer prices are the number one issue on farmers’ minds as they begin to set up purchases for the 2022 growing season.”

The combination of fewer food staple exports and higher production costs is likely to drive the price of all foods up as consumers pivot to keep their pantries stocked. People facing food insecurity are at the greatest risk of famine due to Russia’s invasion of Ukraine. Either there simply will not be enough food to go around, or the prices will be too high to afford. This humanitarian disaster is one that there is still time for the international community to mitigate with effort.

As individuals, many of us are already doing our best to support our allies in Ukraine and the surrounding areas that are taking in refugees. Action to prevent loss of life and livelihood for these people is the top priority. We can also begin to think about actions that can be taken to try to mitigate the effects of the war on the supply chain, and in turn, help to reduce the likelihood of famine in food insecure areas and countries that rely heavily on Russian and Ukrainian exports.

Supply chain professionals can start to diversify their raw materials supply now, begin to prioritize exports to heavily affected areas as possible and work to reduce waste in their supply chains. Reducing waste should be a top priority for all companies. Not only because it positively affects the bottom-line, but because initiatives to use less gas, waste fewer raw materials or better utilize fertilizer will help to keep costs down worldwide. It may seem like one company’s efforts are too small, but together they can add up.

Internally at Alloy we are running an employee donation program that is matched by the company up to $100 per person. Charities featured include UNHCR USA (the UN Refugee Agency), the Canadian Red Cross and the German Red Cross. Every effort counts, even those that seem small now within the supply chain can have ripple effects that improve someone’s life in another country. We keep all those affected in our thoughts.

With the right data, consumer brands can determine whether their demand is rising, falling, or re-distributing due to COVID-19, without waiting for retailers

Keep readingThis data gives consumer goods companies a leg up on the competition and allows them to more proactively anticipate their retailers' demand plans.

Keep reading