Logistics Predictions: How Did We Do in 2022 and What Will 2023 Look Like?

Logistics Viewpoints

DECEMBER 1, 2022

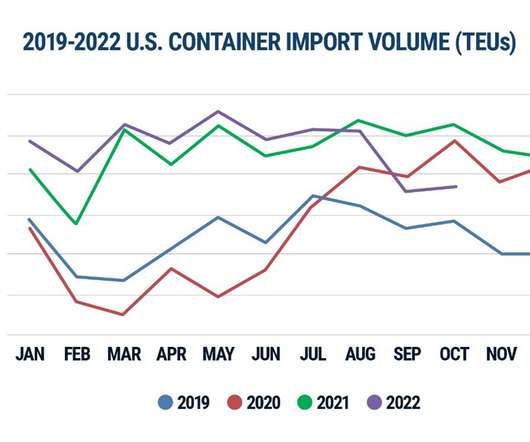

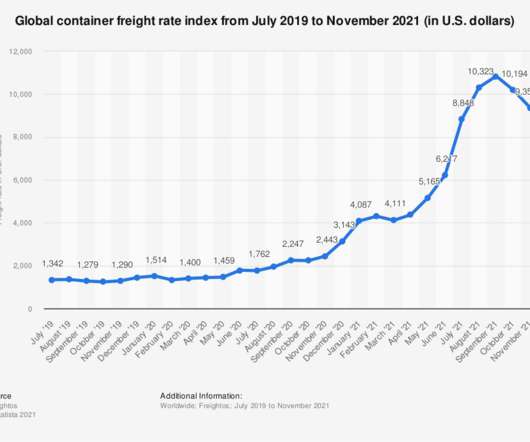

Near the end of 2021, I had the chance to make the early call on Logistics Viewpoints on what 2022 would look like across five major logistics themes. There were record numbers (see Figure 1) through August 2022 and even when September’s volumes receded they were still 7% higher than pre-pandemic 2019. Figure 1: U.S.

Let's personalize your content