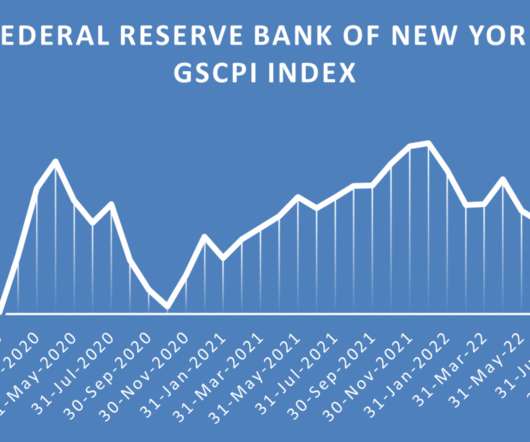

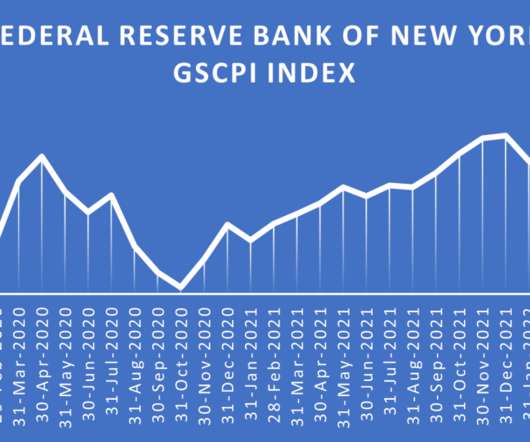

Global Supply Chain Volatility Continues to Moderate But Not Inventory and Warehousing Costs

Supply Chain Matters

OCTOBER 12, 2022

The takeaway for September was that global manufacturing activity officially fall below the 50.0 According to the September report , growth is increasing for inventory levels, inventory and warehousing costs. In a prior Supply Chain Matters posting, we highlighted both September and Q3-2022 global and regional PMI indices.

Let's personalize your content