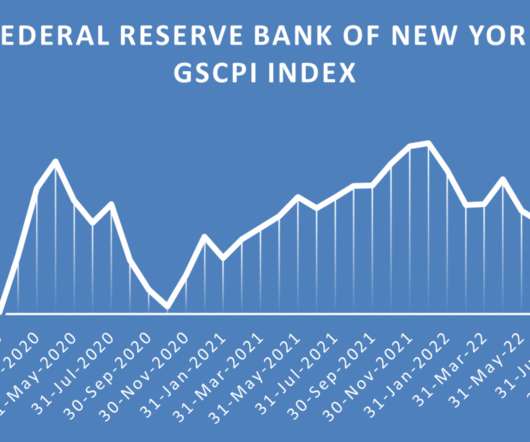

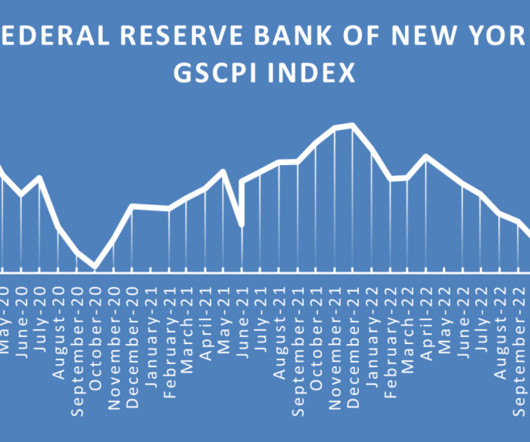

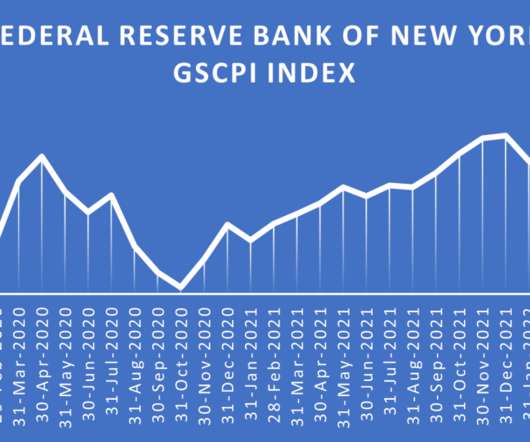

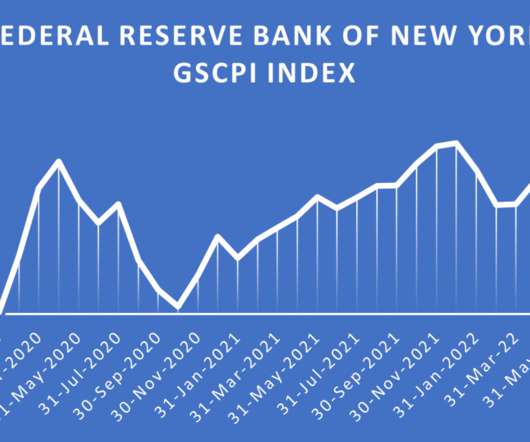

Global Supply Chain Volatility Continues to Moderate But Not Inventory and Warehousing Costs

Supply Chain Matters

OCTOBER 12, 2022

This index compiles 27 different variables to include transportation movement and costs, global PMI sub-indexes reflecting delivery times and order backlog. Interestingly, Transportation Utilization is the outlier here, as both utilization metrics in the index were up significantly in September. ”. up from an August reading of 59.7.

Let's personalize your content