July 2022 Global Manufacturing Indices Indicating Declining Momentum

Supply Chain Matters

AUGUST 3, 2022

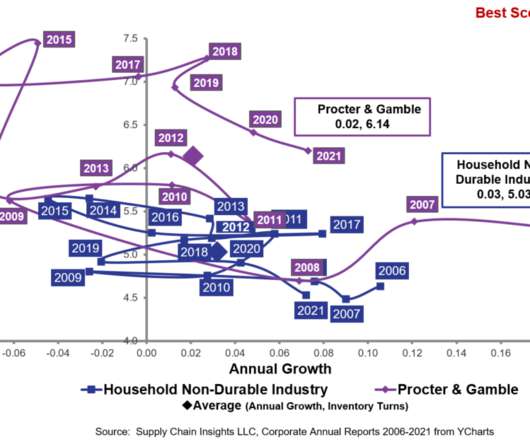

The Supply Chain Matters blog provides commentary relative to July’s global manufacturing PMI indices relative to data indicating declining momentum, and some contraction among specific global regions. Morgan Global Manufacturing PMI® report, a composite index produced by J.P. Global Wide Production Activity. The July 2022 J.P.

Let's personalize your content