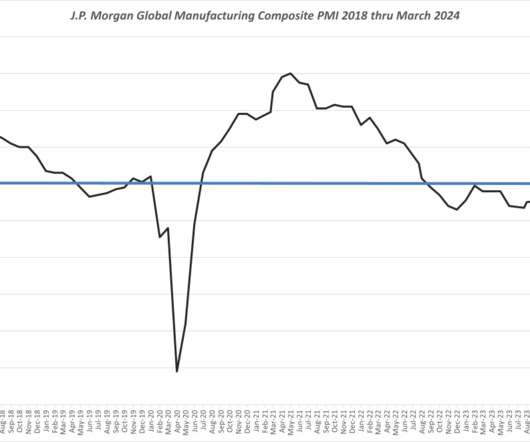

Global Wide Manufacturing Output Strengthens in March 2024

Supply Chain Matters

APRIL 5, 2024

The Eurozone remains a drag on global manufacturing output with reportedly steep downturns again occurring in Germany and Austria. New order growth reportedly accelerated at the fastest in nearly three plus year, which is a likely indication that this region has become the new go-to for China Plus product sourcing strategies.

Let's personalize your content