The Coffee Pot Conversation That Will Not Happen

Supply Chain Shaman

JUNE 7, 2021

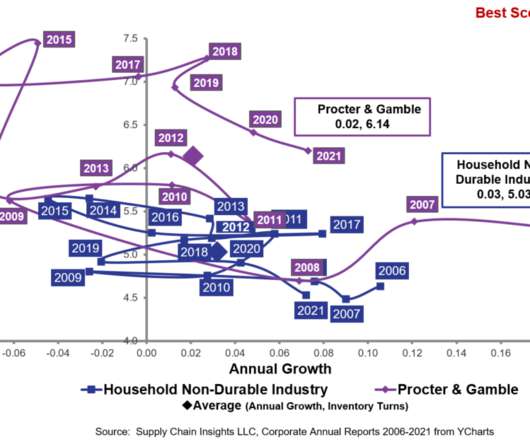

I began analyzing correlations of groups of metrics to market capitalization and found that the most significant correlation was between market capitalization and growth. Initially, I worked with Arizona State statistics professors and graduate students to correlate market factors to 2006-2012 data.) I hope to see you there!

Let's personalize your content