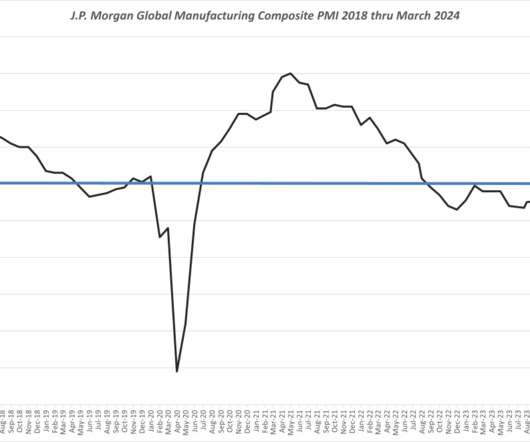

Global Production Levels Falling At the End of 2023

Supply Chain Matters

JANUARY 8, 2024

This index is a compilation of seven ASEAN nations- Indonesia, Malaysia, Myanmar, the Philippines, Singapore, Thailand, and Vietnam. Declines in the manufacturing sector were noted for Myanmar , Thailand , and Malaysia. These nations reportedly account for 98 percent of ASEAN manufacturing value added. by the end of the year.

Let's personalize your content