Global Wide Production PMI Levels Unchanged in February 2024

Supply Chain Matters

MARCH 5, 2024

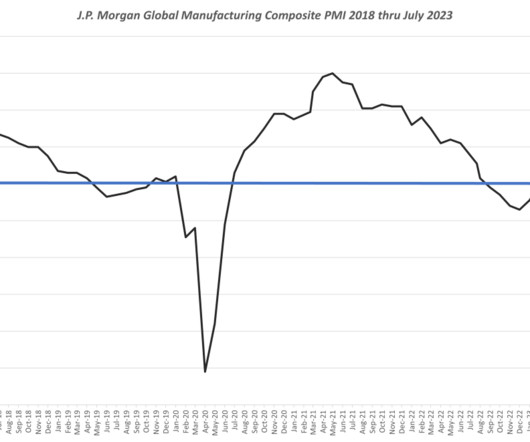

Output reportedly rose in China, India, Brazil and the United States , while declines continued in the Eurozone , Japan and the United Kingdom. United Kingdom manufacturers additionally pointed to the ongoing Red Sea shipping crisis leading to added supply disruptions. The February 2024 reading of 50.3

Let's personalize your content