U.S. Freight Rates Reach Six Year Low Milestone

Supply Chain Matters

APRIL 7, 2023

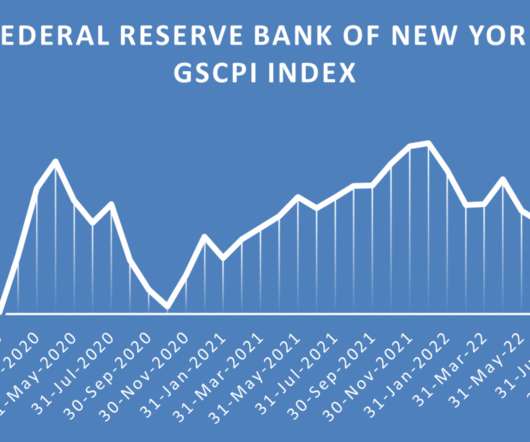

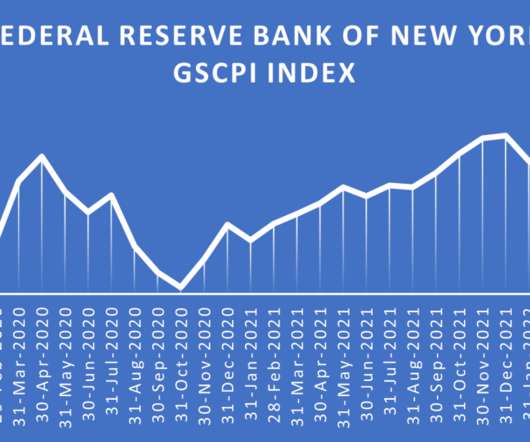

freight rates have reached their lowest levels in nearly six years. In essence, it is confirmation of a freight recession condition. That is not good for retailers and manufacturers, each under the looking glass to reduce not only transportation but also inventory carrying costs. All rights reserved. The post U.S.

Let's personalize your content