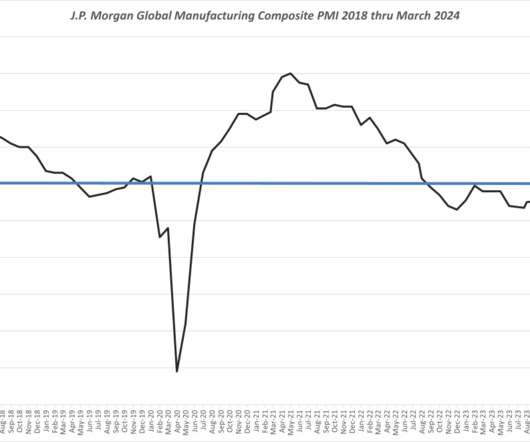

2024 Predictions for Industry and Global Supply Chains- Prediction Two

Supply Chain Matters

JANUARY 9, 2024

The Ferrari Consulting and Research Group through its affiliate the Supply Chain Matters blog shares samples of individual prediction snapshots that will be included in our Annual 2024 Predictions for Industry and Global Supply Chains Research Advisory publishing later this month. Such efforts indeed occurred as was added evidence.

Let's personalize your content