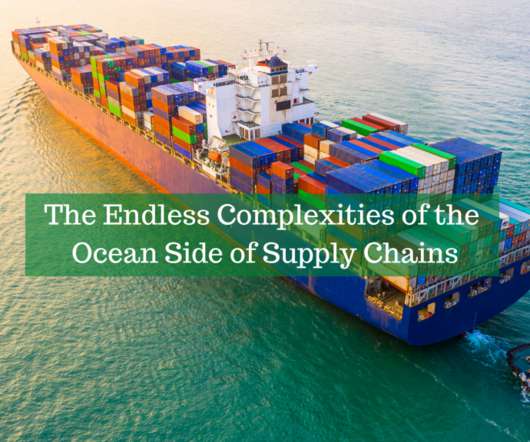

The Endless Complexities of the Ocean side of Supply Chains

SCMDOJO

MAY 13, 2022

The advent of containerization heralded a revolution in cargo handling techniques, the ramifications of which are still influencing maritime trade all over the world today. Source: project44 Monthly report. ports of Los Angeles and Long Beach which saw their busiest March on record, handling a combined 898,287 TEU’s.

Let's personalize your content