The Unleashed Manufacturing Health Index: Signs of Recovery as 2023 Closes

Unleashed

DECEMBER 13, 2023

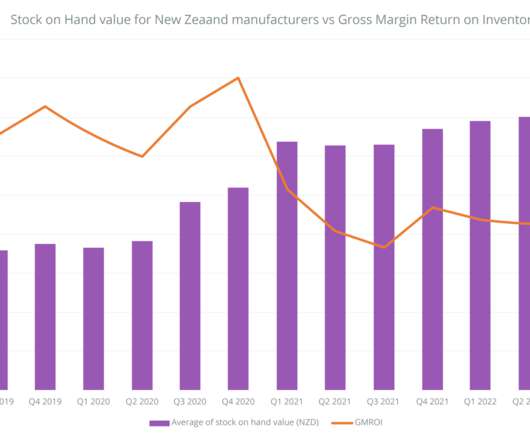

Faring worse than any other UK industry by a significant margin at 18, While in regions like New Zealand, the Food and Beverage industries have tended to index to one another, there’s been a fork in the road for UK food manufacturers and their beverage cousins. However quarter-on-quarter profitability for the sector is trending down.

Let's personalize your content