The Pros and Cons: International and Domestic Sourcing

Unleashed

DECEMBER 15, 2019

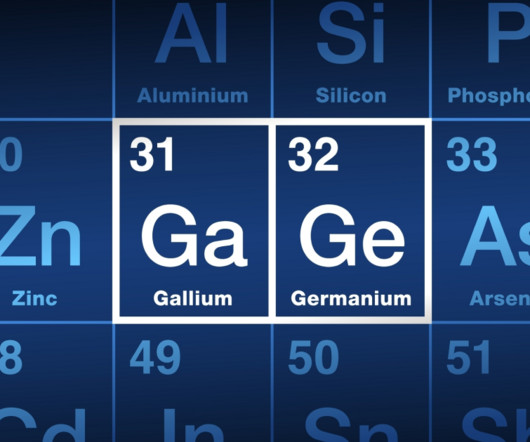

It’s easy to oversimplify the differences between sourcing for parts locally or internationally. When considering where to purchase from, the prevailing idea seems to be that domestic sourcing allows for better control and shorter lead time, but international sourcing is more cost-effective. International Sourcing.

Let's personalize your content