The US FDA’s Phase-Out of Synthetic Food Dyes – Supply Chain Impacts & Challenges

Logistics Viewpoints

APRIL 23, 2025

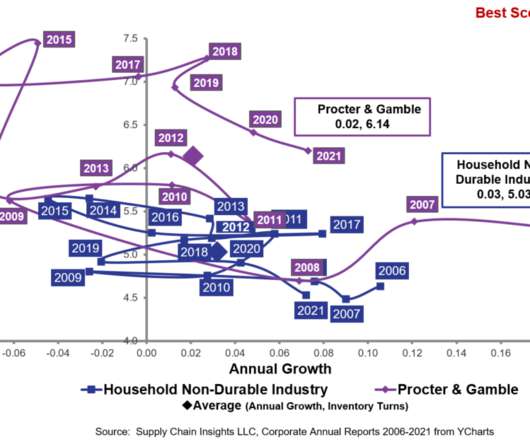

From raw material sourcing to logistics and regulatory compliance, stakeholders across the value chain will need to prepare for structural adjustments. Sourcing and Ingredient Availability A central impact of this policy is the need to replace synthetic colorants with natural alternatives.

Let's personalize your content