Measuring Up?

Supply Chain Shaman

MARCH 28, 2016

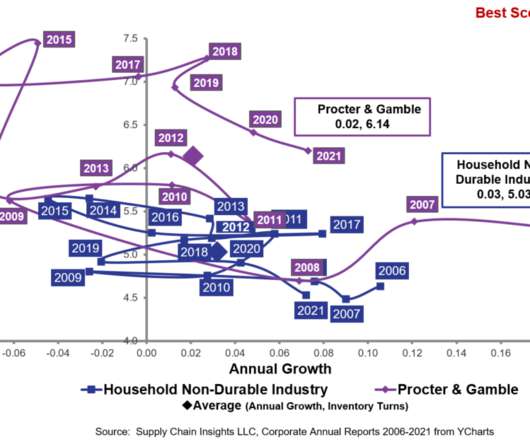

The average manufacturing company’s supply chain organization is 15 years old. The first step in the journey is to analyze balance sheet results and understand industry trends. To help, in this post, we provide you with some insights for the period of 2006-2015. The first question to answer is, “What defines value?

Let's personalize your content