Supply Chain Normalcy? Think Again.

Supply Chain Shaman

APRIL 18, 2023

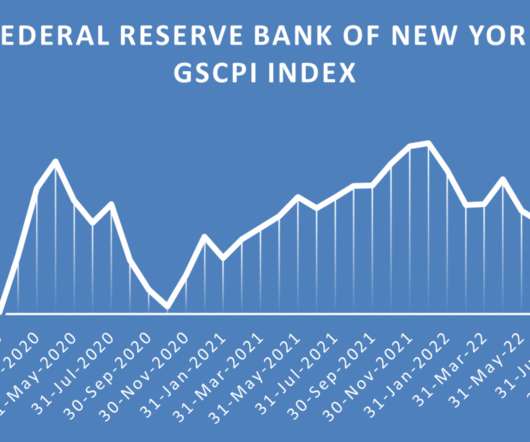

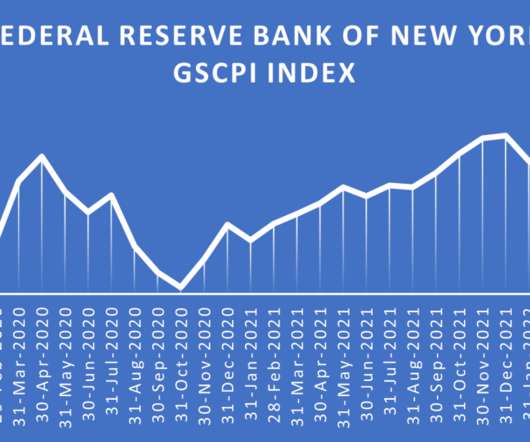

As consumer spending fell, the days of escalating ocean freight and extreme shipping variability eased this year. In the spring of 2022, Asia/US ocean container rates resumed pre-pandemic levels and congestion eased in November 2022 into California ports. Build in-market sourcing. The peak disruption was in December 2021.

Let's personalize your content