How Can You Improve Value in Your Supply Chain?

Supply Chain Shaman

JANUARY 7, 2025

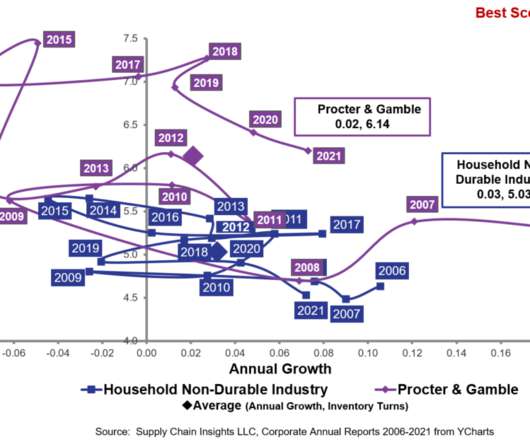

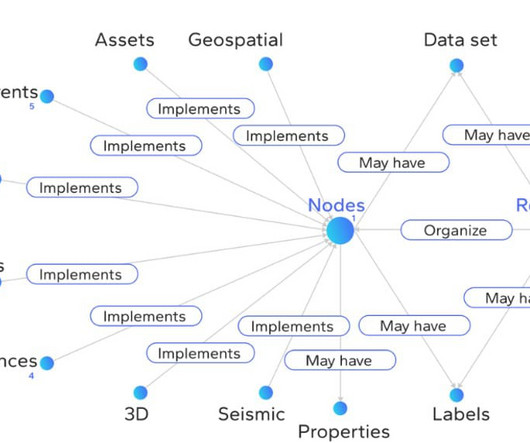

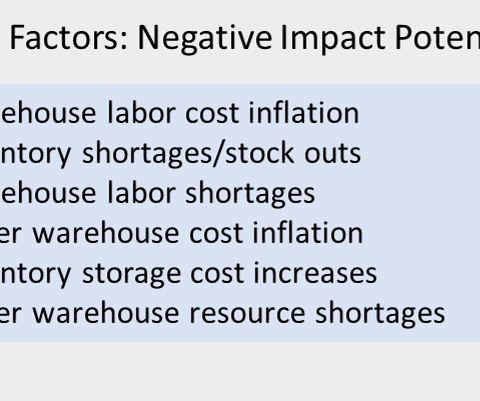

In today’s architectures and functional metrics, value optimization does not exist. And, when procurement and tactical planning operate in isolation, there is no decision support framework to guide the trade-offs especially when the functions are tethered to different and conflicting metrics. You are right.

Let's personalize your content