Supply Chain Normalcy? Think Again.

Supply Chain Shaman

APRIL 18, 2023

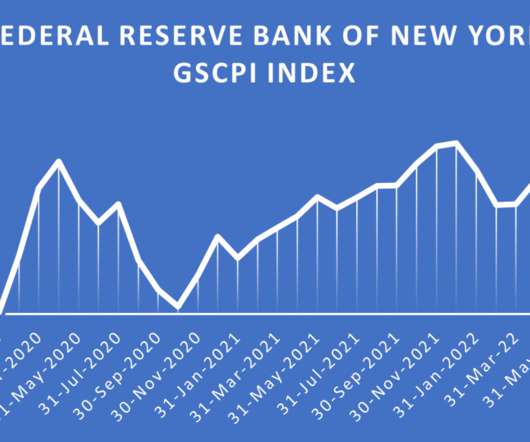

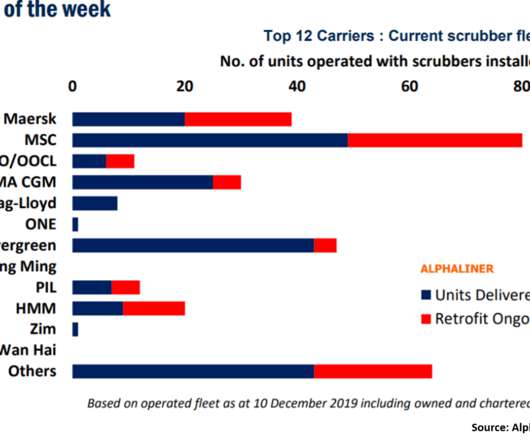

Growing tensions between China and trading partners. As consumer spending fell, the days of escalating ocean freight and extreme shipping variability eased this year. For organizations layered in functional metrics and driving a cost agenda, this is a tough nut to crack. Over four-hundred days of war in Ukraine. Unrest in Sudan.

Let's personalize your content