Uh-Oh! Insights On How P&G Failed And What This Means For You

Supply Chain Shaman

APRIL 27, 2022

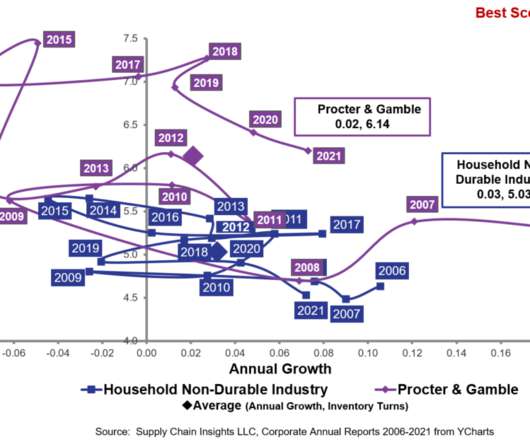

At each company, there is a relationship between the metrics of growth, margin, inventory, customer service, and asset strategy. For the purpose of this article, I will use Return on Invested Capital (ROIC) as the proxy metric to discuss asset utilization.) Shown in Figure 2, we track the results for the period from 2006-to 2021.

Let's personalize your content