How We Stubbed Our Toe in The Evolution of S&OP

Supply Chain Shaman

FEBRUARY 14, 2022

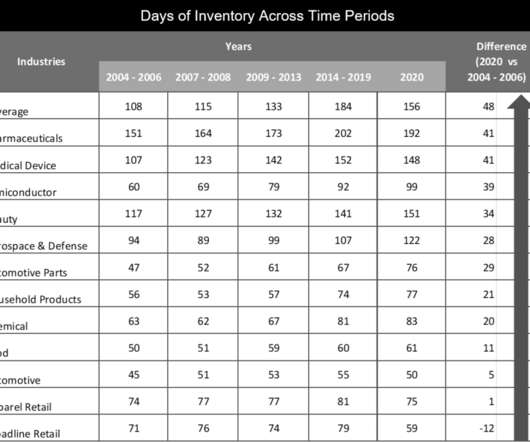

Sales and Operations Maturity Model from 2005-2008. Notice how the water turns from blue to brown in Figure 3 with the lack of demand translation capabilities within the enterprise for manufacturing and logistics. Orchestration enables companies to effectively manage trade-offs between source, make, deliver and sell.)

Let's personalize your content