Inventory is Everything with Jeff Flowers

The Logistics of Logistics

JUNE 17, 2022

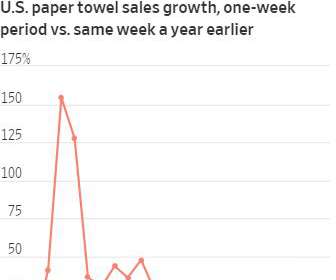

Jeff Flowers and Joe Lynch discuss why inventory is everything. Jeff’s professional career began in accounting and finance roles within the Cable Television, High Speed Data and IPTV industry. Key Takeaways: Inventory is Everything. Inventory placement and excess inventory are big problems that omni-channel retailers face.

Let's personalize your content