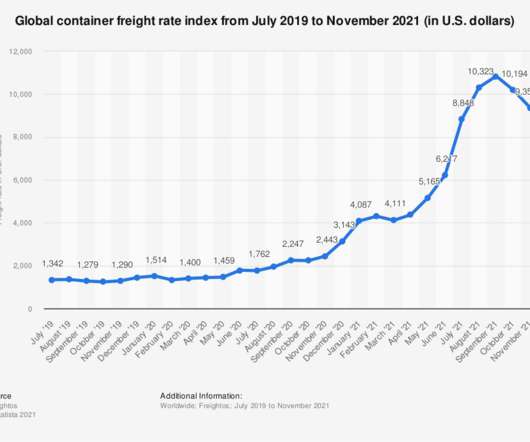

High freight costs for importers means higher price tags for consumers

Freightos

DECEMBER 2, 2021

You might not think about shipping containers and ocean freight when you click “buy” on your Amazon order, but there’s a direct connection between the two. However, since buying goods manufactured primarily in Asia increased so significantly, demand quickly outpaced supply. But elevated freight rates have pushed costs to $4-5 per unit.

Let's personalize your content