Global Wide Manufacturing Output Strengthens in March 2024

Supply Chain Matters

APRIL 5, 2024

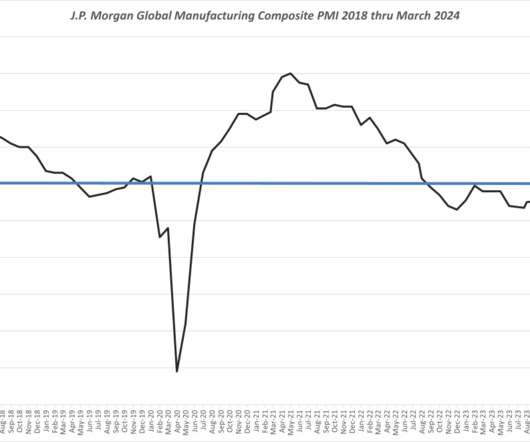

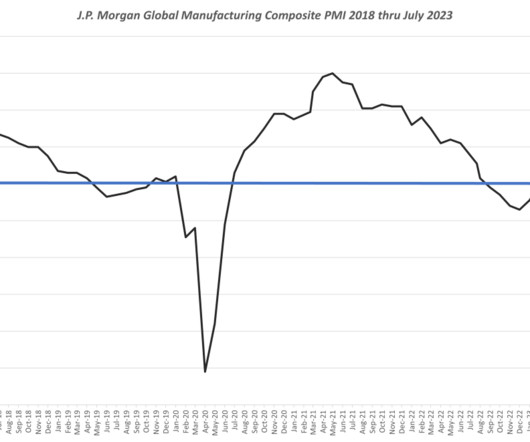

Global Manufacturing Output Levels Strengthen Global-wide manufacturing levels as depicted in the J.P. Morgan Global Manufacturing PMI® ended March on an optimistic footing. Of further significance was the March report indication that the rate of growth in global manufacturing output has accelerated to a 21-month high.

Let's personalize your content