How Can You Improve Value in Your Supply Chain?

Supply Chain Shaman

JANUARY 7, 2025

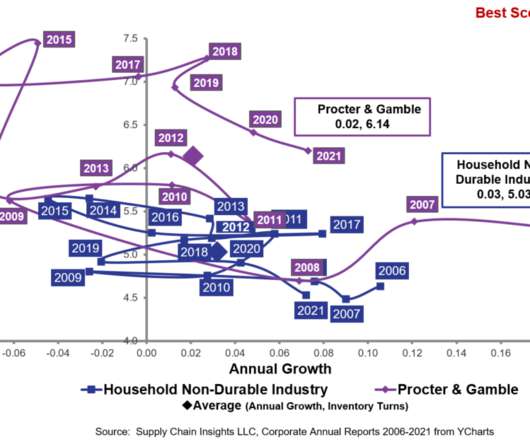

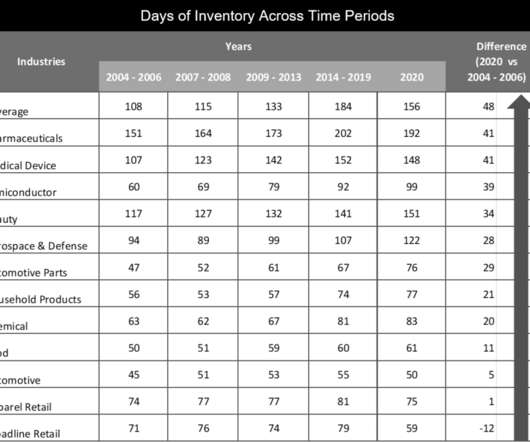

To build an outside-in model, and use new forms of analytics, we must start the discussion with the question of, “what drives value?” ” Traditional planning models optimize functional processes to improve cost and customer service. You are right. The answer is not th e Gartner Top 25.

Let's personalize your content