Build Resilient Supply Chains That Weather Disruptions

Logility

MARCH 29, 2022

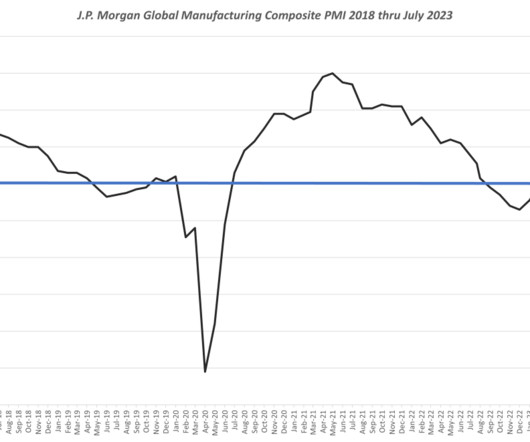

Can the United States be far behind? This exposed structural weaknesses, including giving many a pause for thought about over-reliance on Chinese goods and the fact that most supply chains lack the ability to rapidly shift production and logistics in response to demand. .

Let's personalize your content