Mastering Disruption: A Smarter, More Connected Approach

Logistics Viewpoints

MARCH 27, 2025

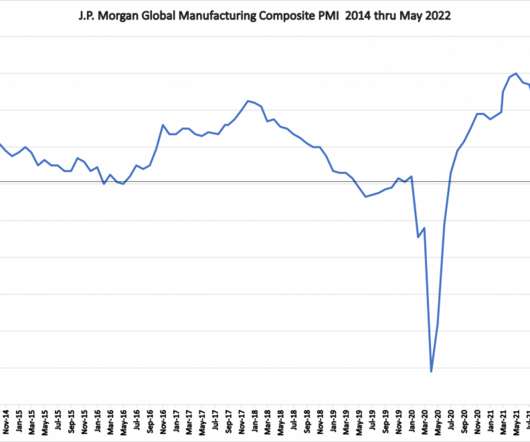

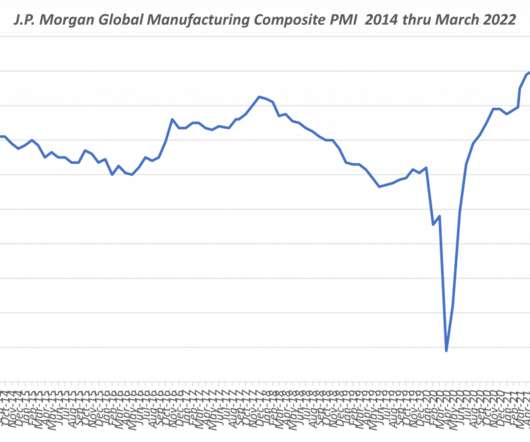

The Ukraine-Russia conflict is ongoing. A disruption at any point in the global logistics network including the average of 12 touch points from shipment packaging to final delivery can prove disastrous for profits, service levels, customer loyalty, and other key metrics. With the global e-commerce market predicted to reach $8.1

Let's personalize your content