September and Q3 2022 Global Manufacturing Indices Enter Contraction Trending

Supply Chain Matters

OCTOBER 4, 2022

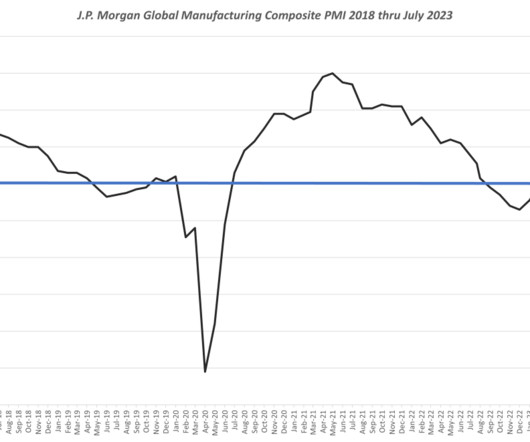

Supply Chain Matters provides our monthly highlights commentary and perspectives on published monthly global manufacturing PMI and supply chain activity indices. Now, with September and full Q3 reporting available, global manufacturing activity has officially fallen below the 50.0 Global Wide Production Activity. represented a 0.5

Let's personalize your content