Understanding the Shipping Container Shortage!

Supply Chain Game Changer

JULY 2, 2021

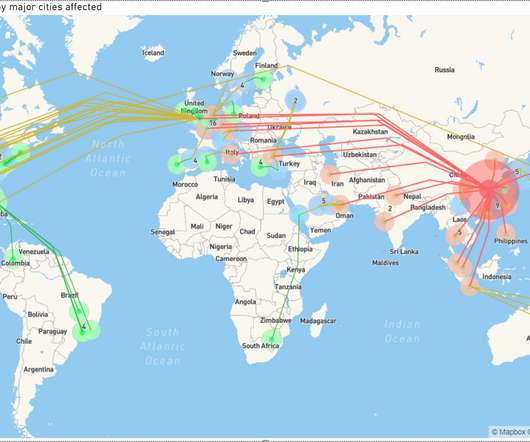

Shipping container shortage article and permission to publish here provided by Sam White at Argentus. The massive global shipping squeeze. In their story about the shipping shortage, the CBC quoted shipping analyst Alan Murphy, who detailed how this changing demand has massively disrupted the global shipping market.

Let's personalize your content