Announcing the Supply Chains to Admire 2015

Supply Chain Shaman

SEPTEMBER 9, 2015

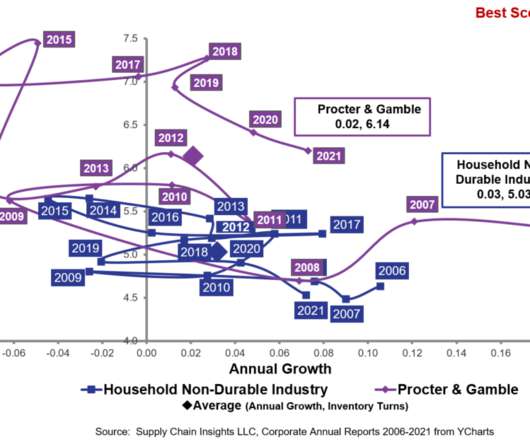

Tomorrow, I present the Supply Chains To Admire 2015 Analysis at the Supply Chain Insights Global Summit in Scottsdale, AZ. At the event, we will also announce the winners of the Supply Chains to Admire methodology for 2015. The theme is “Imagine the Supply Chain of 2025.” Sharing of the Supply Chains to Admire Work.

Let's personalize your content