The Best Explanation for the Supply Chain Crisis Yet

Logistics Viewpoints

DECEMBER 6, 2021

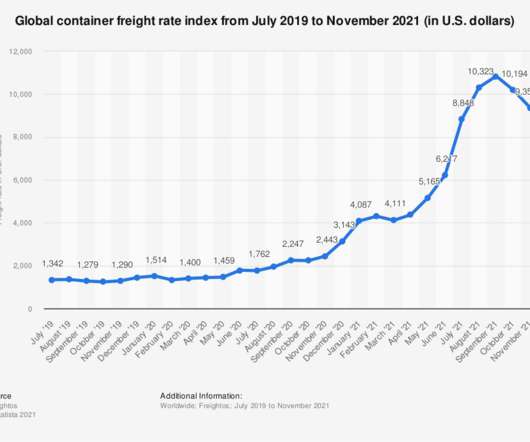

As Asia-Pacific production ramped up, competition was on to source the scarce goods and to get access to the limited transportation capacity available to move these goods to their destinations. When there’s more demand than supply, prices go up, as we saw in previous months with record -high prices for ocean and air cargo moves.

Let's personalize your content