This Week in Logistics News (January 20 – 26)

Logistics Viewpoints

JANUARY 26, 2024

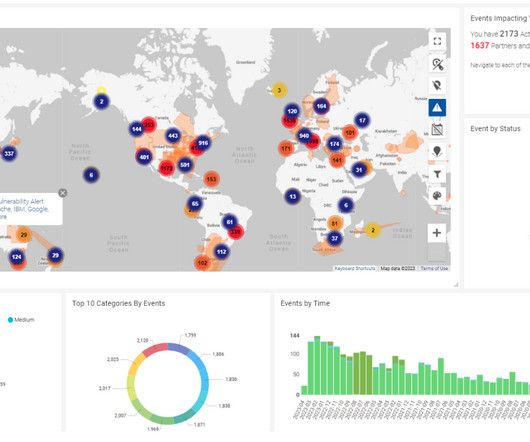

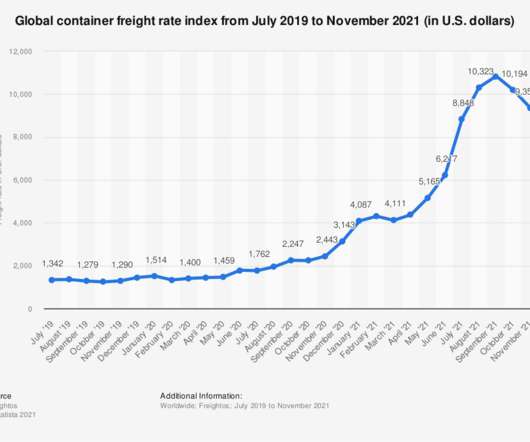

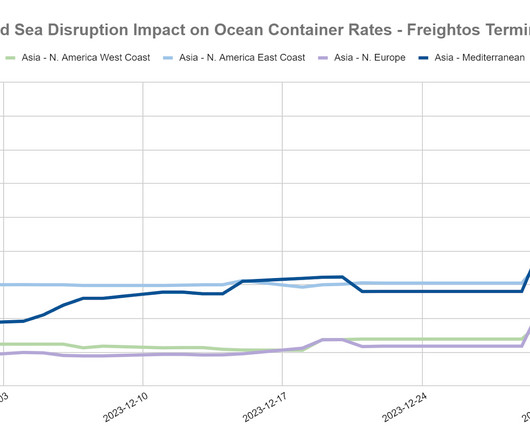

Global shipping prices are continuing to rise as Houthi rebels keep up attacks on cargo vessels in and around the Red Sea. Several cargo vessels were struck by missiles or drones during the past week. The Panama Canal has faded from the headlines amid all the focus on the Red Sea.

Let's personalize your content